Enhance your dashboard experience with the latest SSA UI kit components

In this update, we introduce three exciting new components that help developers build more interactive dashboards: Gauge Chart, TreeMap Chart, and Form Builder.

April has been an incredibly productive month for ctbots.ai platform, marked by major upgrades and innovative features. We’re thrilled to unveil a new lineup of tandem trading bots tailored for both balanced and high-volatility portfolios, alongside the launch of a Telegram notification feature that keeps you informed about bot performance—right in your pocket.

Let’s take a deeper dive into what crypto trading bots are, how they work, and explore the exciting tools we’ve developed to help you navigate the crypto market more intelligently.

In simple terms, a crypto trading bot is a software tool that automatically buys and sells cryptocurrencies on your behalf. It operates according to a defined strategy and executes trades at optimal times—without emotions, fatigue, or hesitation. Think of it as a robot trader that works around the clock, scanning market conditions and responding faster than any human could.

The bot begins by connecting to your preferred crypto exchange—such as Binance, MEXC or ByBit—using secure API keys. Once connected, it constantly monitors market data, analyzing price movements, trading volume, and chart patterns in real time.

From there, the bot applies pre-defined strategies based on technical indicators like RSI, MACD, moving averages and SSA Group’s proprietary trade algorithms. When conditions match the strategy, it automatically places buy or sell orders, acting within milliseconds. Built-in risk management features such as stop-losses and take-profit rules help preserve capital and secure gains.

The result? A smart, fast, and consistent trading assistant that doesn’t sleep or second-guess.

Bots can follow a variety of trading strategies, each suited to different market conditions. Some track trends, buying as prices rise and selling as they fall. Others engage in arbitrage, profiting from small price differences across exchanges. Market making bots create liquidity by placing buy and sell orders simultaneously, while scalping bots perform numerous micro-trades to accumulate quick profits throughout the day.

Each method brings its own advantages and risk considerations, and at ctbots.ai, we give you the tools to choose what fits your trading style best.

Yes—provided they are configured correctly. Security is a top priority at ctbots.ai. Bots operate using API keys with trading-only permissions, meaning they can’t withdraw funds. Still, it’s important to remember that no strategy, bot-driven or not, can eliminate market risk entirely. Bots are powerful tools, but they’re not magic—they rely on smart strategy and sound judgment.

At ctbots.ai, we offer a diverse set of bots designed for different trading appetites. Our portfolio is divided into three primary categories—low-volatility, balanced, and high-volatility bots—enabling users to align their trading approach with their risk profile.

Within each category, you’ll find different bot configurations:

As of now, the platform offers the following bots, each optimized for specific market conditions and exchange platforms:

Standard bots

Tandem bots

Plus bots

The bot portfolio is constantly evolving, with new strategies and trading pairs added regularly. To view the latest bots and explore performance statistics, visit ctbots.ai.

The crown jewel of our April update is the launch of tandem trading bots. These bots are designed to work in coordinated pairs, responding more effectively to shifting market conditions—especially in periods of low or high volatility.

In each tandem, the Base bot serves as the core strategist. It monitors a broad market range and makes the key decisions. When the market stabilizes, it activates the Pro bot, a specialized partner optimized for rapid and precise trading within a narrower band. As soon as market volatility spikes again, the Base bot takes back control, adjusting to the new dynamics.

What makes this approach so effective is the constant communication between the two bots. They collaborate in real time, share signals, and coordinate their roles to improve trade timing, reduce risk, and adapt more flexibly to the market’s tempo.

The Base bot is equipped with three clever behavioral modes. In Chasing, it adjusts its trading range to follow price movements dynamically. Teasing mode introduces a brief delay when prices approach a target, holding off to see if a better entry or exit is possible. Finally, Reverse Teasing allows the bot to wait for the market to swing back before acting when price momentum reverses direction.

These behavioral patterns help optimize when and how the Pro bot is activated, allowing the tandem to fine-tune its performance in quieter periods.

The benefit of tandem bots lies in their flexibility and synergy. They offer smarter entry points, more refined risk management, and a more responsive approach to fluctuating market conditions. Whether you’re a beginner exploring the crypto space or a seasoned trader seeking more precision, tandem bots bring a new level of adaptability to your trading strategy.

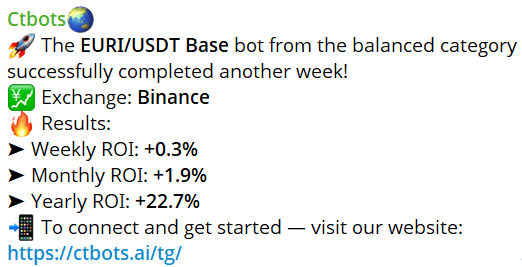

Not quite ready to activate a bot, but want to observe how it performs in real market conditions? We completely understand—and that’s why we’ve introduced Telegram-based performance updates to keep you informed and confident.

Once a new bot is launched and completes a successful performance cycle—typically a week—you’ll receive a notification directly via Telegram. After that, you’ll get regular performance updates, allowing you to monitor results, identify patterns, and decide if the strategy aligns with your trading goals.

To make this even easier, we’ve set up dedicated Telegram channels for each version of the ctbots.ai platform:

These notifications are powered by SSA Group’s proprietary NuGet package, an enterprise-grade integration tool that works seamlessly with .NET applications and supports a range of messaging platforms, including Slack, MS Teams, SMS and even more channels. With customizable templates and channel-specific delivery, it ensures that you stay informed in the way that suits you best.

By joining the Telegram channel for your region, you’ll be the first to know about new bot launches, high-performing strategies, and key product updates—no extra steps or logins required.

Join our Telegram channels today to stay up to date with the latest bot launches, updates, and results. If you’re curious about how tandem bots can improve your crypto trading strategy, head over to ctbots.ai to explore your options.

We’re here to help you trade smarter, with confidence and clarity—every step of the way.

In this update, we introduce three exciting new components that help developers build more interactive dashboards: Gauge Chart, TreeMap Chart, and Form Builder.

Today, the benefits of outsourcing in the IT industry are undeniable, offering so much more than a simple reduction in software development costs.

you're currently offline