SWEDEN

SWEDEN Self-ordering Platform

A digital ordering solution for the food & beverage industry

SWEDEN

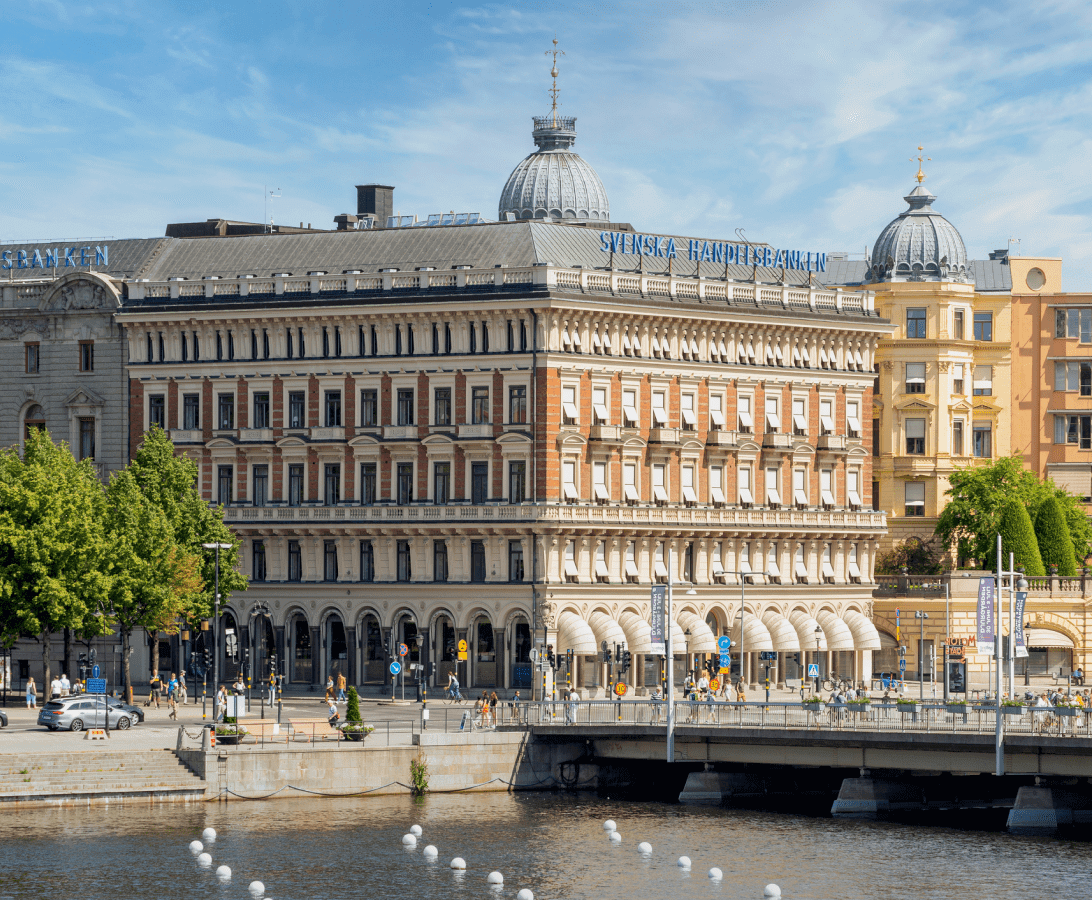

SWEDEN The Nordics have a history of digitally-savvy citizens and businesses. In turn, the Swedish financial market has been one of the pioneers in digital transformation long before it became mainstream.

Retail banks in Sweden offered private loans traditionally until the early to middle 2000s, when new-gen players started seizing the market. As the tech-focused newbies had been rapidly changing the game rules, they shortened traditional banks’ market share to 35-45% by 2016.

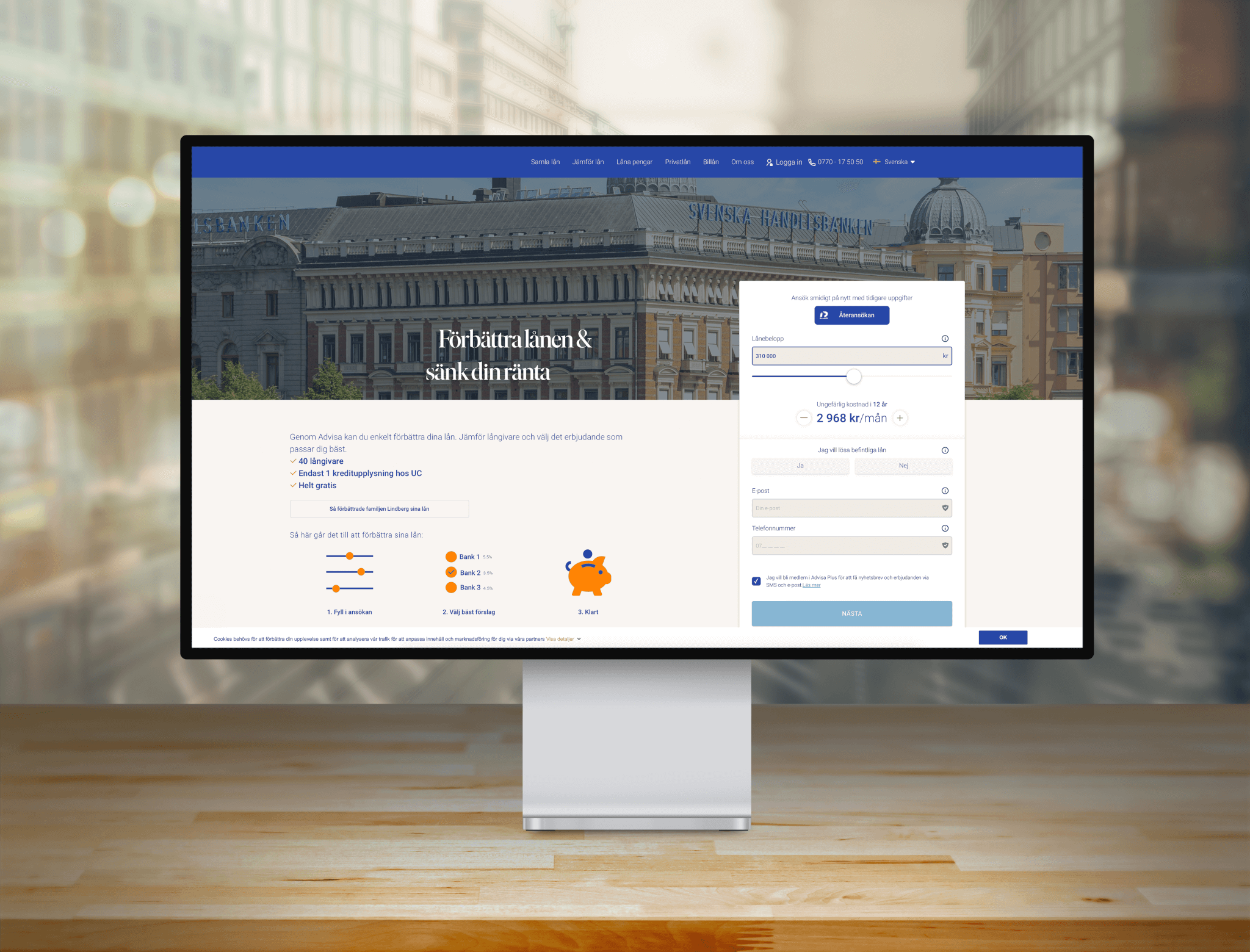

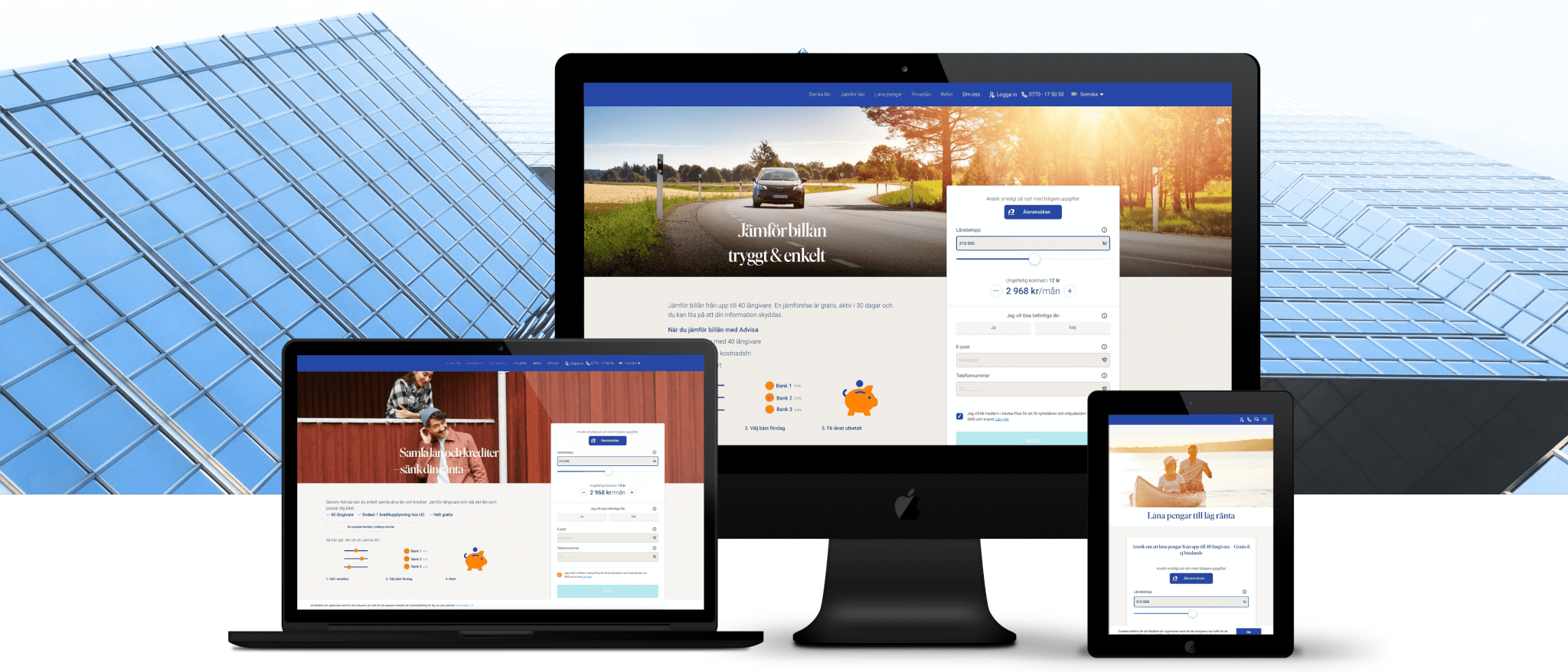

Our client is a leading Swedish loan broker that has helped over 250k citizens to find the most suitable loan offer according to their requests. The broker service includes private loan comparison, personal protection cover and expert advisory, so the company cooperates tightly with a range of trusted banks and credit unions.

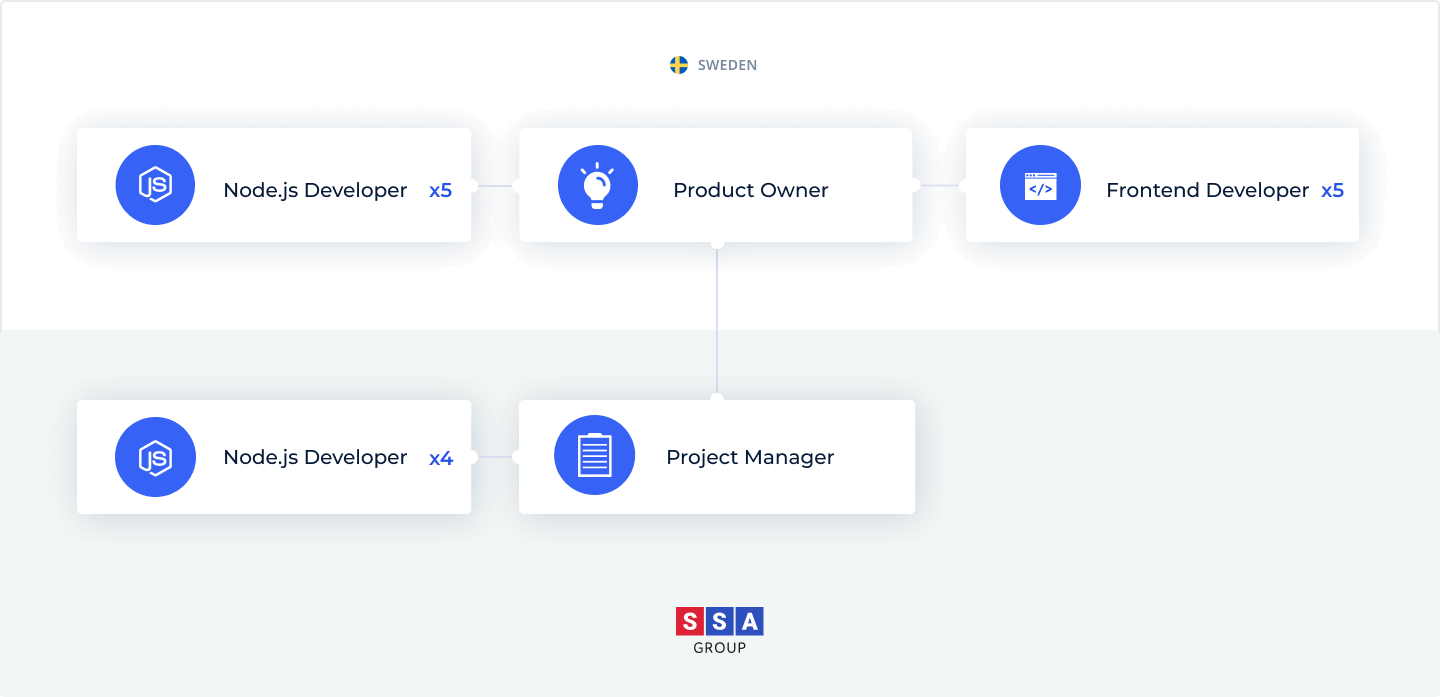

In 2012 the client came up with the challenge to unite all the partners within a digital infrastructure with the client’s app as a single customer touchpoint. So, the SSA Group’s task was to create robust connections between more than 30 independent apps of banks and credit unions and ensure seamless real-time data exchange across them.

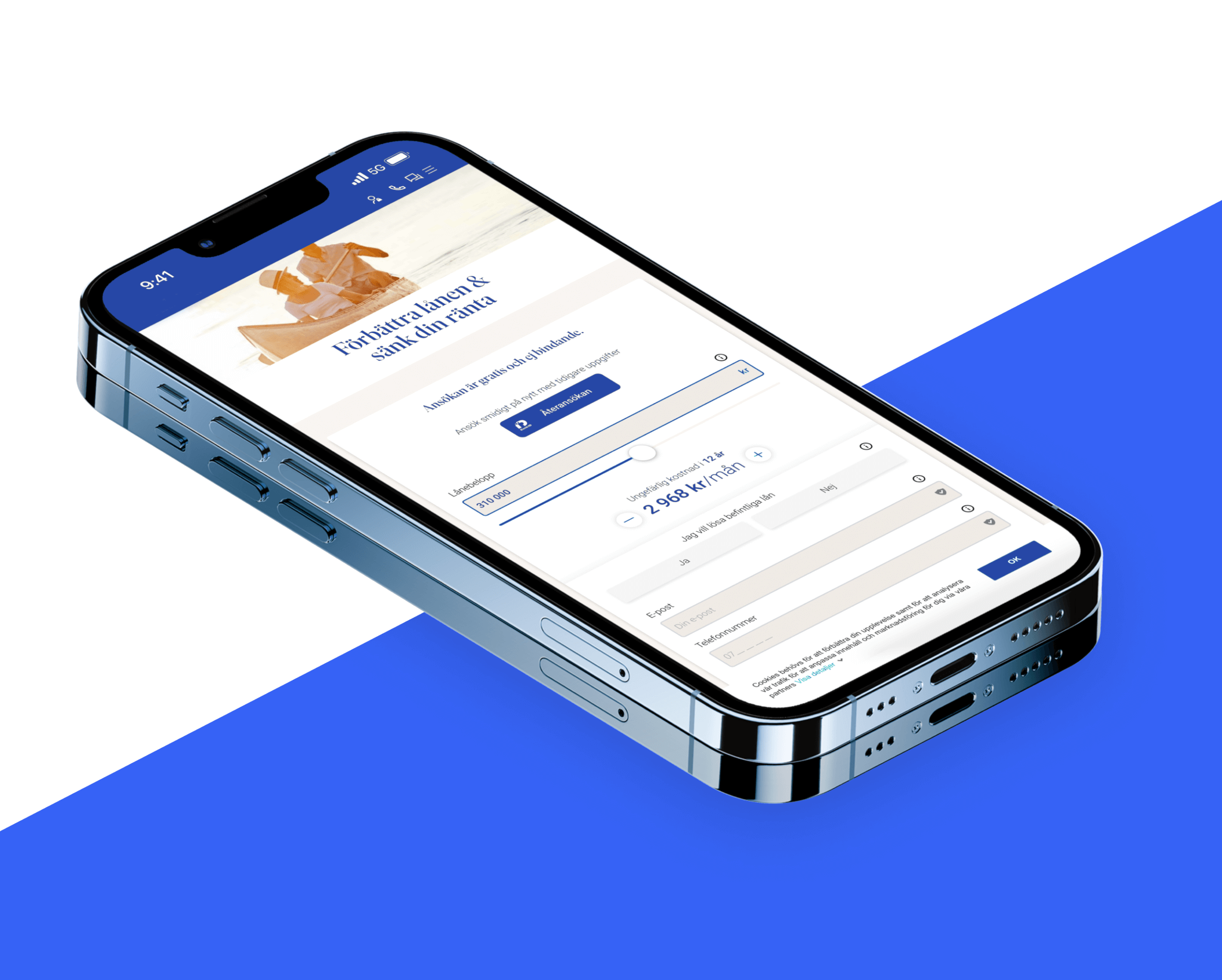

The Loan Adviser evaluates multiple offers provided on the request by trusted lenders and automatically selects the most optimal fit. The SaaS platform covers the entire loan lifecycle, saving time and ensuring an easy borrower journey. Also, the competitive environment of a digital lending hub pushes banks and credit unions to higher loyalty and reduced interest rates to get more contracts signed.

The multiple data connectors established by SSA Group's specialists between the lenders allow them to share borrower profiles and reuse customer insights to drive personalized product offerings. In addition, automated daily processes, including risk assessment, lower lenders' operational expenses and enable them to handle applications faster than competitors.

The Loan Adviser is a win-win solution that benefits all parties in the lending process.

For borrowers:

For lenders:

SWEDEN

SWEDEN A digital ordering solution for the food & beverage industry

SWEDEN

SWEDEN Social mobile application for people with addictions

Keep a close watch on your inbox. We’ll get in touch with you in no time.

Please fill out the quick form and we’ll be in touch with lightning speed

you're currently offline