SSA CTP: Crypto trading platform and strategy automation

Are you a business in the capital markets domain or an individual trader and have an idea for crypto trading? If so, our team of experts can formalize your strategy, validate it in a simulation environment, run it and monitor 24x7x365 all within SSA CTP.

SSA CTP delivers a set of tools and a framework for building AI-driven automated crypto trading solutions of any scale and complexity.

Live numbers

Crypto trading strategy automation workflow

Don't have an idea yet but still would like to trade? Check out our ready-to-go trading bots!

Crypto trading automation platform

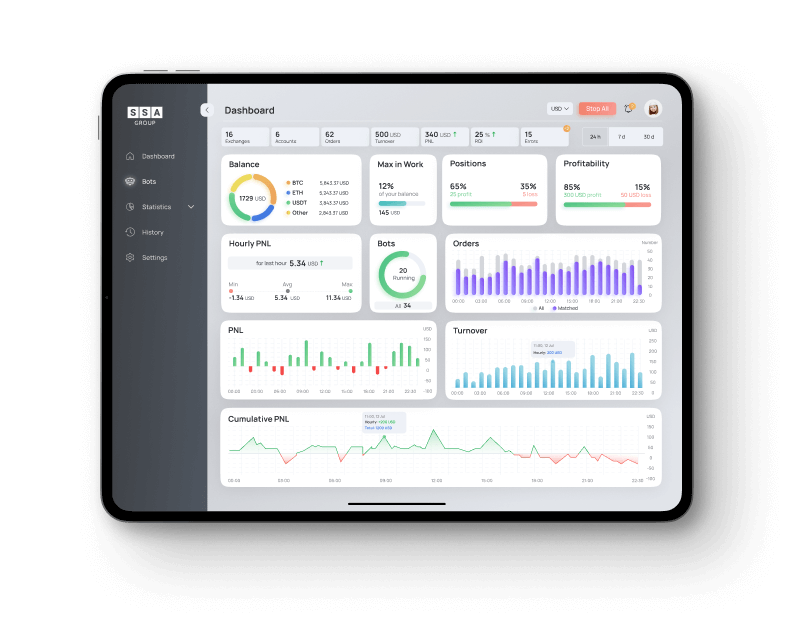

SSA CTP comprises Dashboard, Mobile app, Bot framework and Simulation environment integrated together

Dashboard

- Bot management (start/stop, settings, clone, archive)

- Bot monitoring

- Notifications

- Emergency stop

- Account statistics

- Bot statistics

- Reports

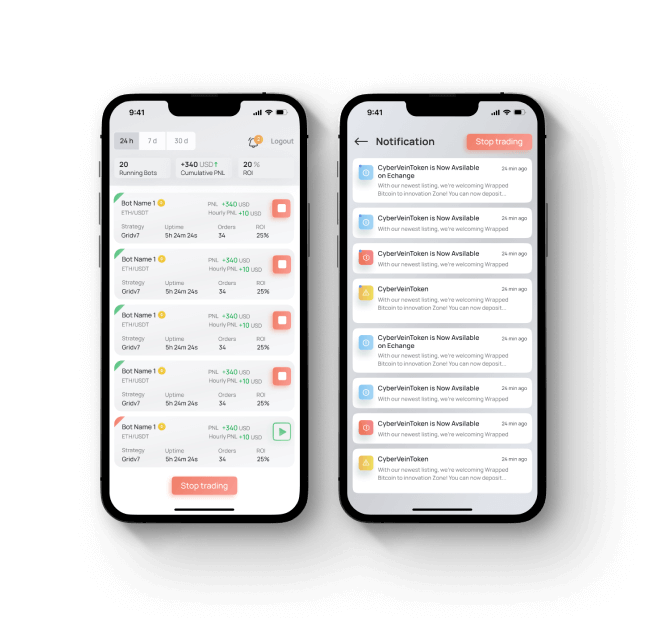

Mobile app

- Bot start/stop

- Notifications

- Emergency stop

- P&L, ROI for account

- P&L, ROI per bot

Bot framework

Simulation environment

Simulation or backtesting is aimed at validating the trading strategy using historical market data to assess its potential performance and effectiveness before deploying it in live trading.

The bot created for simulation (Simulation Bot) uses literally the same codebase as the bot for live trading (Live Bot) with the only difference in data sources, i.e. the database with historical data for simulation and real-time data coming from crypto exchanges for live bots.

This ensures that the AI trading bot crypto performs accurately and effectively across both environments.

Historical data

The historical data used for simulation includes price movements, trading volumes and market depth since January 1st, 2021 for the following pairs:

- BTC/USDT

- ETH/USDT

- BTC/TUSD

- XRP/USDT

- BNB/USDT

- LTC/USDT

Simulation

The discrete-event simulation allows to investigate the strategy performance 20-30 times faster than the actual time range.

Fine-tuning & enhancements

Fine-tuning of different strategy parameters allows to choose the best configuration resulting in the optimal key metrics such as profit and loss (P&L), return on investment (ROI), drawdowns, win rate, etc. The accuracy of results is in the range of 5%.

Technical notes

- Spot and Isolated Margin trading

- Any instruments supported

- One CTP account supports multiple exchange accounts

- One bot supports one exchange and one instrument only

- One bot per exchange account

- Every bot operates in the isolated container environment

- New bot launch time – 1 month on average

Crypto exchanges

Business model

Legal matters

FAQ

-

What industries provide crypto trading bot development services for?

SSA Group develops crypto trading bots for industries such as capital markets, fintech, hedge funds, asset management, and retail traders, offering solutions for each sector.

-

How do I choose the right crypto trading bot development company?

Choose a company with expertise in AI and crypto markets, customizable bots, strong backtesting and simulation capabilities, 24/7 support, and robust security measures, like SSA Group.

-

What kind of results can I expect from crypto trading automation?

Expect 24/7 automated trading, consistent performance, reduced emotional decisions, improved efficiency, and data-driven insights, leading to optimized profitability and risk management.

-

What techniques do your crypto trading bot developers use?

Our developers use AI & machine learning, backtesting with historical data, grid & cross trading, risk management algorithms, and real-time market data processing for optimal bot performance.

-

How fast is your crypto trade simulator?

SSA Group’s crypto trade simulator runs 20-30 times faster than real-time, enabling rapid strategy testing and optimization.

-

What benefits do I get with your crypto AI trading bot?

Our AI crypto bots provide adaptive learning, real-time analysis, emotion-free trading, faster execution, and advanced risk management for higher efficiency and profitability.

-

What kind of programming languages do you use for crypto trading bot development?

SSA Group primarily uses C#, TypeScript and SQL. These programming languages offer the flexibility and performance needed to build scalable, efficient, and secure trading bots that integrate seamlessly with crypto exchanges.

-

How accurate is SSA Group’s crypto trading simulator?

It uses real historical data, offering a highly accurate simulation of market conditions. It allows you to test strategies with precision, mimicking live trading environments for effective strategy validation.

-

How can I get started with crypto trading automation?

To get started, simply fill out and submit the contact form below. Our crypto bot developers will help you formalize your strategy, build a custom bot, and guide you through the process of deploying and monitoring it for optimal performance.

Your message has been sent!

Keep a close watch on your inbox. We’ll get in touch with you in no time.

Have an idea for crypto trading strategy?

Please get in touch to formalize, simulate and run your strategy